As retirement investors, our 30 year plus investment horizon (a typical retirement), requires us to be very long-term investors. Proper asset allocation is vital, however present interest rates available on U.S. government bonds are so low, we can be certain we will lose money. What to do?

- The math

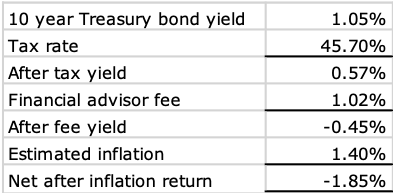

- The present annual yield on the 10-year U.S. treasury bond is 1.05% (per Marketwatch.com)

- Taxes on interest income are higher than on qualified dividends or long-term gains – the tax rate for interest income for a NY investor making $500K per year is 45.7%

- The average financial advisor fee is 1.02% per year (per Investopedia.com)

- Inflation was 1.4% in 2020 and has averaged 2.9% per year since 1926

- What are the alternatives?

- Sound retirement investing requires proper diversification and asset allocation. One strong alternative is to move a portion of your bond investments into a diversified portfolio of high-quality dividend paying stocks and increase your exposure to real estate and other real assets.

- Putting fixed income investments into an IRA reduces the tax disadvantage of interest income by deferring the taxes due until withdrawal.

- Every dollar less in fees paid to financial advisors goes into your pocket. And over 30 years, compounds into a very large amount of money.

- Get a financial review by a highly skilled advisor with your best interests at heart.

Disclaimer: All information provided is for educational purposes only and does not constitute investment, legal or tax advice, or an offer to buy or sell any security. Source for all return data is “2020 Stocks, Bonds, Bills and Inflation Yearbook”, Roger G Ibbotson and Duff & Phelps. For our full disclosures, click here.