What We Do

Our Strategy

“After 33 years of wall street experience, academic and professional study, and extensive financial market research, I strongly believe that successful retirement investing comes down to 3 must-haves.”

Paul Sebetic, Founder Sebetic Advisors

1

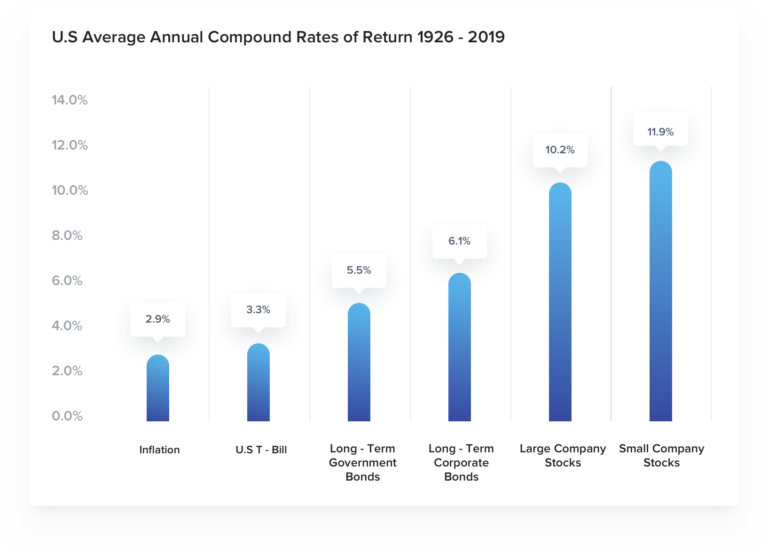

Investment portfolio should have a large allocation to stocks

Throughout history, long-term investing in high quality U.S. dividend stocks has substantially outperformed bonds, cash, and inflation.

For each $100 moved from Long-term Government Bonds to Large Company Stocks, the expected return over a 30-year retirement will result in $81 more after-tax income to spend during retirement and a $261 higher ending balance to pass onto heirs.

For each $100 moved from bonds to stocks, the expected return over a 30-year retirement will result in $81 more after-tax income to spend during retirement and a $261 higher ending balance to pass onto heirs.

2

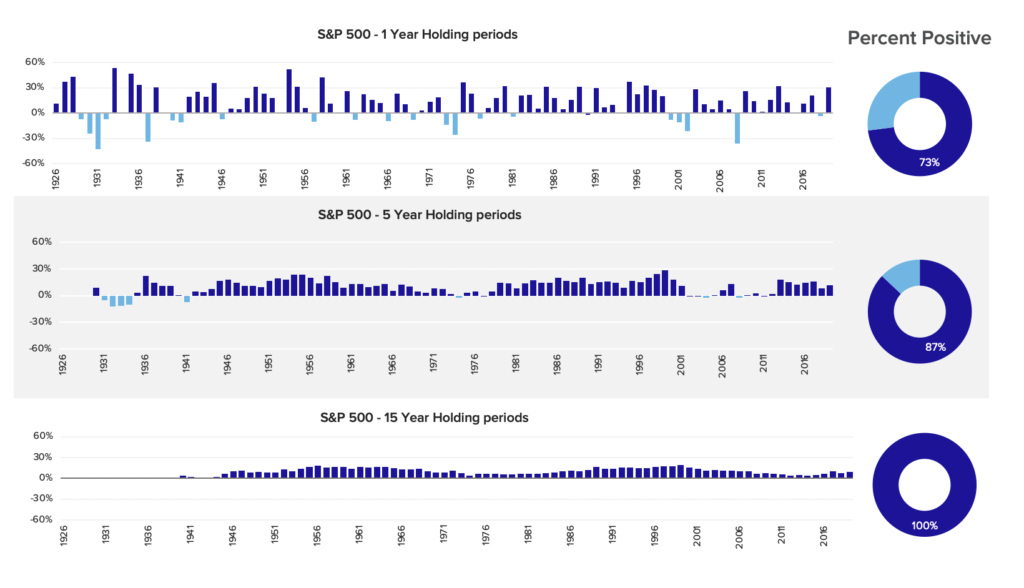

Historically, disciplined stock investing with long term holding periods has completely eliminated the risk of loss from investing in stocks.

Since 1926, U.S. large company stocks have never had a fifteen-year period with a negative return.

3

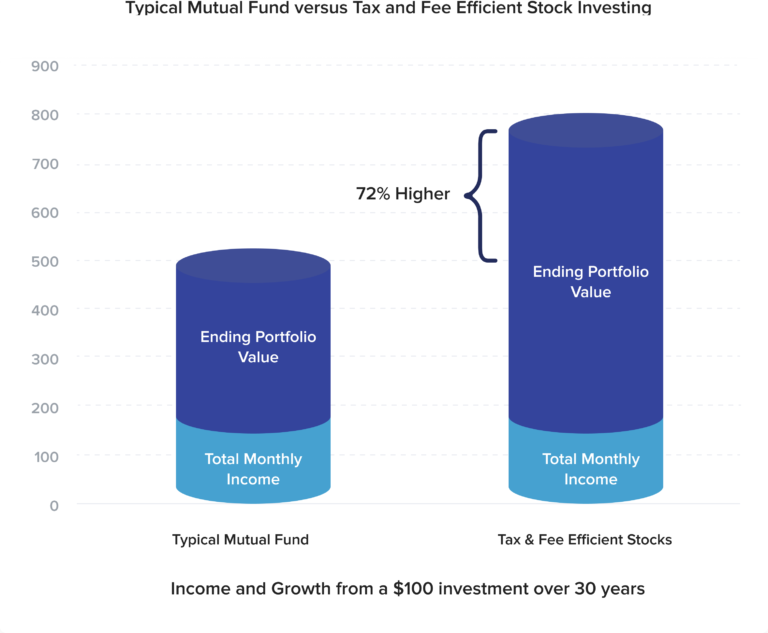

Investing in a lower cost /tax efficient manner over a 30-year period makes a significant difference in the ending investment balance.

A long term buy and hold strategy, coupled with lower costs, can dramatically increase after tax returns. A lower cost tax efficient stock strategy over a 30-year retirement can result in a 72% higher ending balance compared to a typical stock mutual fund.

The Math Behind the Must-Haves

In the example below, we assume that three brothers each have one million dollars to invest over a thirty-year period. Behold the power of the “Three Must Haves”.

Brother 1

Invests 100% in BONDS

Cumulative Income Received

$590,000

Portfolio Ending Value

$1,000,000

Total Value

$1,590,000

Brother 2

Invests 100% in STOCKS

Cumulative Income Received

$1,400,000

Portfolio Ending Value

$3,610,000

Total Value

$5,010,000

Brother 3

Invests 100% in STOCKS in a LOW COST / TAX EFFICIENT MANNER

Cumulative Income Received

$1,400,000

Portfolio Ending Value

$6,220,000

Total Value

$7,620,000

Our Offering

Our Portfolio

Our PortfolioAn equity portfolio specifically designed for retirement investing

- A comprehensive retirement investing strategy OR an excellent complement to an investor’s existing retirement program

- Pays monthly distributions which in the first year will total 4% of the opening capital balance and targets annual increases thereafter equal to inflation

A highly diversified portfolio

- Target 100 companies

- Diversify by sector, industry, country, company size and style

- During periods of elevated equity valuations, may invest in money market funds and or short-term fixed income instruments

Invest in high quality companies

- Strong history of profitability & growth with prospects for continuation in the future

- Strong balance sheets, with either net cash or low levels of debt

- Selling at reasonable valuation levels

Investment Selection Process

Investment Selection ProcessIdentify potential investment opportunities through:

- Market Research

- Investment Periodicals

- Numerous stock filter and screening tools

- 13F Reviews

- Mutual Fund / ETF holdings analyses

- Other

Analyze stocks using Sebetic Advisors Proprietary Valuation Model and 10-Year Return estimating tool

- Tool enables us to quickly screen a large number of stocks

- Only those companies that pass the four qualifiers – rate of growth, rate of profitability, balance sheet strength, and current valuation are reviewed further

Comprehensive review – during this phase we:

- Analyze 20 years of financial statements (or inception to date)

- Review Company’s latest filings on the SEC website

- Review Corporate governance policies

- Review Board and senior management

- Analyze versus competitors and the industry

- Evaluate future prospects and other items

Finally, we select the high quality investments that we want to own “forever”

Portfolio Management

Portfolio ManagementFocus on tax efficiency

- Very long-term holding periods defer taxes

- Dividends / long term capital gains taxed at an advantageous rate

- If clients invest with us in both IRA and taxable accounts, we will seek to locate assets in the most tax efficient vehicle

- We will sell a company if share price increases substantially and we believe there are better alternative investment opportunities (after accounting for taxes on gains)

- We will sell if the company fails to keep up with the conservative forecast created upon investment – either operating income growth or balance sheet strength

- If a company declines substantially in value, but we do not believe the company fundamentals have deteriorated, will look to take a short-term tax loss while maintaining exposure to the company

Diversification – will manage portfolio to diversification targets (sector, industry, country, company size and style)

Summary of Terms

Summary of Terms Safeguarding of Assets

- Client opens a brokerage account at Interactive Brokers, where only the client can deposit and withdraw funds out of the account

- Interactive Brokers’ technology enables the efficient and cost effective replication of our strategy across client accounts

- Client enters into an agreement hiring Sebetic Advisors to manage the portfolio

Low Fees

- Management fee of 0.5% per year

- Fee is approximately 50% lower than the average Financial Advisor fee for clients with a $1 million investment (source: Investopedia)

- A second fee option for qualified investors (investable net worth $2.1 million or more) is available

- Management fee of 0.1% per year and an annual performance fee equal to 1/3 of the excess performance over the S&P 500

Account Size

- Clients typically invest $150,000 or more

Financial Review

Financial ReviewReview

- We will send a preliminary questionnaire so that the client may gather the necessary data and begin thinking about their short and long term goals

- Any data sent will be reviewed and analyzed prior to our meeting

Assess / Recommend

- We will perform a confidential, no obligation retirement financial analysis (either in-person or via video conference)

- Based on our review we will make any recommendations that may be appropriate. Clients typically find this discussion extremely valuable

Share

- We will then discuss the Sebetic Advisors Strategy and Portfolio

- We will provide specifics on investments, investment selection, portfolio management, etc. and answer any remaining questions

Explore

- Together we will explore whether our strategy and portfolio is right for you

- This is NOT a high pressure sales pitch. If our offering makes sense for you, we can explain our onboarding process

Our Offering

An equity portfolio specifically designed for retirement investing

- A comprehensive retirement investing strategy OR an excellent complement to an investor’s existing retirement program

- Pays monthly distributions which in the first year will total 4% of the opening capital balance and targets annual increases thereafter equal to inflation

A highly diversified portfolio

- Target 100 companies

- Diversify by sector, industry, country, company size and style

- During periods of elevated equity valuations, may invest in money market funds and or short-term fixed income instruments

Invest in high quality companies

- Strong history of profitability & growth with prospects for continuation in the future

- Strong balance sheets, with either net cash or low levels of debt

- Selling at reasonable valuation levels

Identify potential investment opportunities through:

- Market Research

- Investment Periodicals

- Numerous stock filter and screening tools

- 13F Reviews

- Mutual Fund / ETF holdings analyses

- Other

Analyze stocks using Sebetic Advisors Proprietary Valuation Model and 10-Year Return estimating tool

- Tool enables us to quickly screen a large number of stocks

- Only those companies that pass the four qualifiers - rate of growth, rate of profitability, balance sheet strength, and current valuation are reviewed further

Comprehensive review – during this phase we:

- Analyze 20 years of financial statements (or inception to date)

- Review Company’s latest filings on the SEC website

- Review Corporate governance policies

- Review Board and senior management

- Analyze versus competitors and the industry

- Evaluate future prospects and other items

Finally, we select the high quality investments that we want to own “forever”

Focus on tax efficiency

- Very long-term holding periods defer taxes

- Dividends / long term capital gains taxed at an advantageous rate

- If clients invest with us in both IRA and taxable accounts, we will seek to locate assets in the most tax efficient vehicle

Continuously monitor valuations

- We will sell a company if share price increases substantially and we believe there are better alternative investment opportunities (after accounting for taxes on gains)

- We will sell if the company fails to keep up with the conservative forecast created upon investment - either operating income growth or balance sheet strength

- If a company declines substantially in value, but we do not believe the company fundamentals have deteriorated, will look to take a short-term tax loss while maintaining exposure to the company

Diversification - will manage portfolio to diversification targets (sector, industry, country, company size and style)

Safeguarding of Assets

- Client opens a brokerage account at Interactive Brokers, where only the client can deposit and withdraw funds out of the account

- Interactive Brokers’ technology enables the efficient and cost effective replication of our strategy across client accounts

- Client enters into an agreement hiring Sebetic Advisors to manage the portfolio

Low Fees

- Management fee of 0.5% per year

- Fee is approximately 50% lower than the average Financial Advisor fee for clients with a $1 million investment (source: Investopedia)

- A second fee option for qualified investors (investable net worth $2.1 million or more) is available

- Management fee of 0.1% per year and an annual performance fee equal to 1/3 of the excess performance over the S&P 500

Account Size

- Clients typically invest $150,000 or more

Review

- We will send a preliminary questionnaire so that the client may gather the necessary data and begin thinking about their short and long term goals

- Any data sent will be reviewed and analyzed prior to our meeting

Assess / Recommend

- We will perform a confidential, no obligation retirement financial analysis (either in-person or via video conference)

- Based on our review we will make any recommendations that may be appropriate. Clients typically find this discussion extremely valuable

Share

- We will then discuss the Sebetic Advisors Strategy and Portfolio

- We will provide specifics on investments, investment selection, portfolio management, etc. and answer any remaining questions

Explore

- Together we will explore whether our strategy and portfolio is right for you

- This is NOT a high pressure sales pitch. If our offering makes sense for you, we can explain our onboarding process